Mortgage Rates 101: Key Insights for First-Time Homebuyers

When purchasing a home, mortgage rates are one of the most crucial factors to consider. Whether you’re a first-time buyer or refinancing, knowing how mortgage rates work can save you thousands of dollars over time. Let’s dive into what you need to know about them and how to get the best deal.

What Are Mortgage Rates?

Simply put, rates are the interest lenders charge you to borrow money for a home purchase. These rates vary and are influenced by several factors such as inflation, economic conditions, and your credit score. Lower rates mean you pay less in interest, which can significantly reduce your monthly payments and the overall cost of your loan.

Fixed vs. Variable

There are two primary types of mortgage rates:

- Fixed-rate mortgages: These loans offer an interest rate that remains the same throughout the loan term, ensuring consistent monthly payments.

- Variable-rate mortgages: Also known as adjustable-rate mortgages (ARMs), these have interest rates that fluctuate based on market conditions. This type of loan often starts with a lower rate but can increase over time.

Choosing between fixed and variable rates depends on your financial situation and risk tolerance. Fixed rates provide stability, while variable rates can offer savings when the market is favourable.

Factors That Determine Mortgage Rates

Several factors influence mortgage rates, including:

- The Federal Reserve: While the Fed doesn’t set rates, its decisions on interest rates heavily affect the mortgage market.

- Inflation: Rising inflation typically leads to higher rates as lenders adjust to maintain their profit margins.

- Economic Growth: Strong economic performance usually drives mortgage rates up, as increased demand for homes leads to higher interest rates.

- Your Credit Score: Lenders use your credit score to assess risk. A higher score often results in lower rates, while a lower score may lead to higher rates.

The Impact of Rates on Your Loan

Even small changes in rates can have a big impact on your finances. For example, a 1% increase in mortgage rates could add hundreds of dollars to your monthly mortgage payment. Over time, this adds up to thousands of dollars in extra interest.

For example, if you borrow $300,000 at a 4% interest rate, your monthly payment would be about $1,432. If rates increase to 5%, that payment would rise to approximately $1,610—a significant difference.

How to Secure the Best Mortgage Rates

Getting the best possible rates requires some preparation. Here are a few steps you can take:

- Improve Your Credit Score: Pay off outstanding debts and keep your credit utilization low. A higher credit score can help you secure lower rates.

- Shop Around: Lenders offer varying rates. Compare offers from multiple institutions to find the best deal.

- Save for a Bigger Down Payment: The more you can put down, the lower your rates may be. Lenders view larger down payments as less risky.

- Lock in Your Rate: If rates are low, consider locking in a rate to protect yourself from potential increases. This can provide peace of mind, especially in a rising rate environment.

Mortgage Rates and Refinancing

If you already have a mortgage, refinancing when rates drop can be a smart financial move. By refinancing to a lower rate, you can reduce your monthly payments and save thousands over the life of the loan.

However, refinancing isn’t free. There are closing costs and fees to consider. Make sure the potential savings from lower rates outweigh these costs before making a decision. If you’re planning to stay in your home for several more years, refinancing could be a great way to take advantage of better rates.

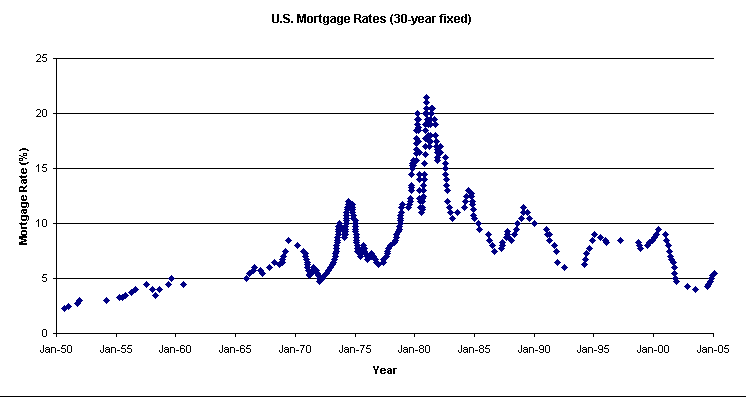

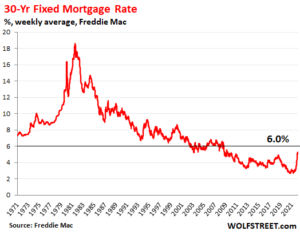

Are Mortgage Rates Expected to Rise?

Many experts predict that rates will rise in the coming years, especially as the economy continues to recover from recent downturns. Inflation and market conditions are likely to push rates higher, meaning now could be a good time to lock in a lower rate if you’re thinking about buying or refinancing.

Staying informed about economic trends can help you anticipate changes in rates and plan accordingly.

Final Thoughts

Understanding mortgage rates is key to making informed decisions about your home loan. Whether you’re buying a new house or considering refinancing, staying up-to-date on the latest trends can help you save money and plan for the future.

By improving your credit score, comparing lender offers, and locking in favourable rates, you’ll be in a strong position to make the most of your home loan. Even a small difference in interest rates can have a big impact on your financial future, so it’s important to take the time to research and prepare.