BABA Stock: Exploring Alibaba’s Investment Potential

Alibaba: A Global Powerhouse in Tech

Alibaba, known as a leader in e-commerce, technology, and cloud computing, is a force to be reckoned with. Founded by Jack Ma in 1999, the company has grown far beyond its Chinese roots. Alibaba’s influence extends to various sectors, including retail, digital payments, and logistics, making BABA stock a key player for investors worldwide.

Why BABA Stock Commands Attention

BABA stock stands out because Alibaba isn’t just an e-commerce giant. The company also has a strong foothold in cloud computing, artificial intelligence, and logistics. This diversification gives Alibaba a competitive edge and makes BABA stock an intriguing investment. Investors looking for exposure to China’s expanding tech and retail markets often turn to the stock for its growth potential.

A Closer Look at BABA Stock Performance

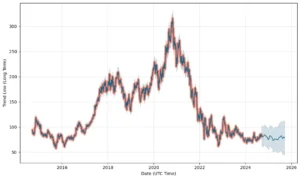

Since its historic IPO in 2014, BABA stock has experienced substantial growth. Initially raising over $25 billion, the largest IPO in history at the time, Alibaba captured the attention of global investors. Although the stock has seen its share of ups and downs, the stock has largely remained a promising investment. Investors who entered early have enjoyed considerable returns, though the stock is not immune to volatility.

Key Factors Driving BABA Stock

Several factors contribute to the value and fluctuations of the stock. Understanding these factors is essential for making informed investment decisions.

China’s Regulatory Influence on BABA Stock

The regulatory landscape in China is one of the most significant forces affecting BABA stock. In recent years, the Chinese government has tightened regulations, especially around anti-monopoly practices and data privacy concerns. This regulatory scrutiny has had a direct impact on Alibaba’s operations, influencing the stock.

For example, the Chinese government’s decision to halt the Ant Group’s IPO in 2020, a company closely tied to Alibaba, caused a notable dip in the stock. Investors need to stay aware of ongoing regulatory developments in China, as these can substantially affect stock performance.

Alibaba Cloud: A Growth Engine for BABA Stock

Another key factor for BABA stock is the success of Alibaba Cloud, the company’s cloud computing division. Alibaba Cloud is the largest cloud provider in China and ranks third globally, competing with Amazon Web Services and Microsoft Azure. The growth potential in cloud services is enormous, and investors see Alibaba Cloud as a major driver of the stock’s future value.

Dominance in E-Commerce: Alibaba’s Stronghold

Alibaba’s stronghold in China’s e-commerce market is a significant reason the stock remains attractive. With platforms like Taobao, Tmall, and AliExpress, Alibaba captures a substantial share of China’s online shopping market. As the Chinese middle class grows, so too does the demand for online shopping, fueling further growth in Alibaba’s business and strengthening BABA stock.

International Expansion: Alibaba’s Global Reach

Though Alibaba is primarily focused on China, the company’s international ambitions have benefited the stock. AliExpress, for instance, has grown in popularity across global markets like Russia, Brazil, and Spain. Additionally, Alibaba’s investments in global logistics and cross-border e-commerce position it well for future growth, further boosting the stock.

Risks Investors Should Consider

While BABA stock presents great opportunities, investors need to be aware of several key risks before jumping in.

Regulatory and Political Risks Facing BABA Stock

One of the biggest risks for BABA stock investors is the regulatory environment in China. The Chinese government has shown it is willing to step in and impose significant restrictions on tech companies like Alibaba. Such interventions can lead to sharp declines in the stock, as seen with the Ant Group’s halted IPO.

Moreover, political tensions between China and the U.S. also impact the stock. Trade wars, tariffs, or increased restrictions on Chinese companies could harm Alibaba’s global operations, potentially causing further declines in stock value.

Competition in the Tech World

Alibaba may be a giant, but it faces stiff competition from both domestic and international rivals. In China, e-commerce platforms like JD.com and Pinduoduo are vying for market share. Globally, companies like Amazon and Shopify challenge Alibaba’s dominance. As competition intensifies, the stock could feel the pressure if competitors manage to capture more of the market.

Market Volatility and Economic Conditions

BABA stock is also subject to market volatility, driven by both global and Chinese economic conditions. Fluctuations in the broader market can cause rapid changes in the stock’s value. Investors should remain aware that the stock can experience both rapid increases and sudden declines, making it important to assess their risk tolerance before investing.

Why the Stock Remains Appealing to Investors

Despite the risks, many investors are still drawn to BABA stock. The company’s solid fundamentals, driven by strong revenue growth and a leading position in key industries like e-commerce and cloud computing, make it an attractive long-term investment.

Additionally, Alibaba’s commitment to innovation and global expansion provides further optimism for the stock’s future performance. Many investors are willing to weather short-term volatility for the potential of long-term rewards with BABA stock.

The Future of BABA Stock: What to Watch For

As Alibaba continues to grow and diversify its business, there are several developments that investors should keep an eye on. First, the performance of Alibaba Cloud remains crucial to BABA stock’s success. Continued growth in this sector could help boost the stock’s value significantly.

Second, any regulatory changes in China could have an immediate impact on the stock. Investors need to monitor shifts in government policies and adjust their strategies accordingly.

Finally, Alibaba’s global expansion is another important factor. If the company can successfully capture more international market share, the stock may experience significant gains. However, competition and political factors will play a role in shaping this outcome.

Conclusion: Is BABA Stock a Good Investment?

BABA stock offers a mix of both high potential and considerable risks. As one of the world’s most influential tech companies, Alibaba is poised for continued growth in several areas, including e-commerce, cloud computing, and artificial intelligence.

For investors willing to accept the risks, the stock can be a valuable addition to a diversified portfolio. However, it is important to remain informed about regulatory developments, economic conditions, and the competitive landscape before making investment decisions.

In the end, BABA stock is a high-reward, high-risk investment that requires careful consideration. Understanding the factors that influence its performance will allow investors to make informed decisions and navigate the challenges that come with this dynamic stock.